Optical characterization of the CM/PCS hybrid (T3). (a, b) Reflection... Download Scientific

Provided User A traded in cross margin mode while User B traded in isolated margin mode. (Trading fees and interest are not considered in this example). DAY ONE. User A (Cross Margin) User B (Isolated Margin) Assets. 5 ETH. 5 BCH. 5 ETH. 5 BCH. Collateral. 400 USDT. 200 USDT. 200 USDT. Margin Level (5 ETH * 200 + 5 BCH * 200) / 1600 = 1.25 (5.

Tbeam crosssection (E = λE E0) [m] (left). Relative error decay vs.... Download Scientific

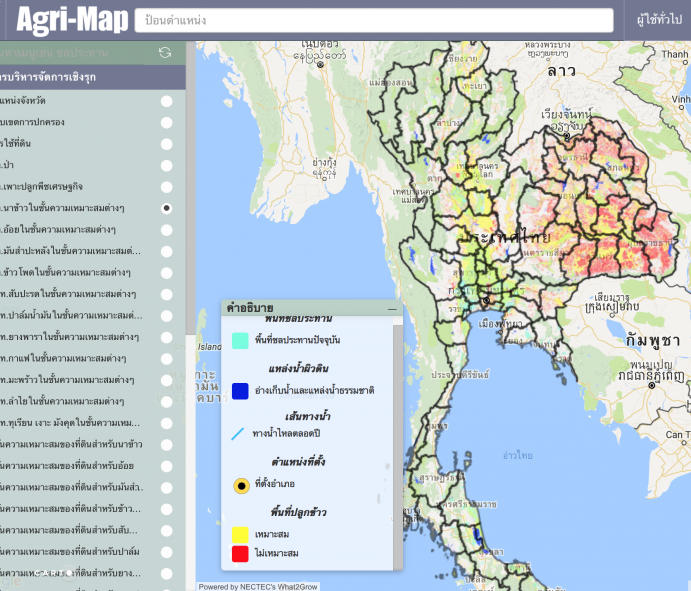

Binance Margin Trading has recently launched isolated margin mode, alongside its existing cross margin mode. You may select Cross 5x or Isolated 5x on the new trading page, as shown below. In isolated margin mode, the margin is independent in each trading pair:. Each trading pair has an independent isolated margin account.

E0 B8 9b E0 B8 81 E0 B8 84 E0 B8 B2 E0 B9 80 E0 B8 9f E0 B9 88 E0 B8 Free Download Nude Photo

Leverage adjustments under different margin modes. By default, positions are opened using Cross Margin mode, and the leverage can be adjusted under both Isolated and Cross Margin modes. After the adjustment, the position margin will be recalculated, please pay attention to the change in liquidation price.

e0b984e0b894e0b884e0b8b1e0b897e0b8ade0b8b0e0b884e0b8a3e0b8b4e0b8

Cross margin allows for the sharing of margin balances across multiple positions, while an isolated margin is assigned to a single position, which cannot be shared. A smart cross margin allows for margin requirement offsets for positions in opposite directions and across different product types. The main potential advantages of smart cross.

Cross Margin. In Cross Margin mode, the entire available balance is automatically utilized to prevent liquidations. The funds in your available balance are shared across multiple positions under the same trading account. Users do not need to manually allocate funds to maintain minimum margin requirements. Instead, the Phemex crypto trading.

e0b89ee0b8b7e0b989e0b899e0b897e0b8b5e0b988e0b8aae0b8b5e0b981e0b8

When engaging in margin trading on LBank, you need to choose between the two margin modes: Cross Margin and Isolated Margin. Cross Margin Mode. Cross Margin Mode is a margin setting where a single margin balance is shared among all your open positions. This means that the entire margin balance acts as collateral for all your active trades.

5e0b980e0b897e0b884e0b899e0b8b4e0b884e0b980e0b8a5e0b8b7e0b8ade0

In other words, the cross margin mode is to put all the eggs in one basket, while the isolated margin mode is to spread the eggs into multiple baskets. The isolated margin mode is generally more suitable for short-term investors or novice users who are new to contract trading. Through position and margin segregation, potential losses are.

Crosscontrol of polarization and Prior to the... Download Scientific Diagram

Isolated Margin is the margin balance allocated to an individual position. Isolated Margin mode allows traders to manage their risk on their individual positions by restricting the amount of margin allocated to each one. The allocated margin balance for each position can be individually adjusted. If a trader's position is liquidated in.

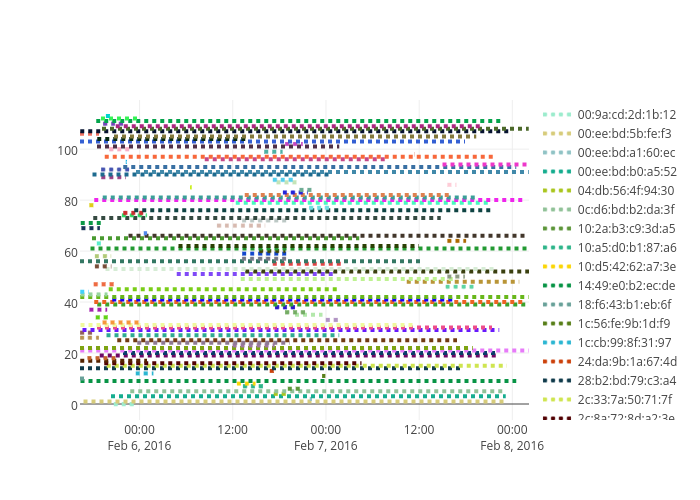

009acd2d1b12, 00eebd5bfef3, 00eebda160ec, 00eebdb0a552, 04db564f9430

Isolated margin mode enhances the strategies of traders that like to pursue varying strategies and limit their risk exposure to a single account. On the contrary, cross margin trading lets you build up a massive portfolio in comparison but leaves your entire trading position with a general liquidation risk.

การบวกลบปริมาณที่มีความคลาดเคลื่อน ฟิสิกส์วันละนิด EP.6 YouTube

On DueDEX, Cross Margin mode is set as default. You can switch to Isolated Margin by using the leverage slider on the right side of the Trade Dashboard. (see picture below) The leftmost mode is.

e0b899e0b989e0b8b3e0b895e0b881e0b8a3e0b989e0b8ade0b899e0b884e0b8

The most commonly-used margin mode across exchanges is called cross margin. In this mode, your entire account balance is used to margin all open positions. The good part about cross margin is that P&L from one position can be used to support a position that is close to liquidation. Depending on the platform, this works with unrealized P&L too.

E0 A4 86 E0 A4 9c E0 A4 B9 E0 A5 8b E0 A4 B2 E0 A5 80 E0 A4 95 E0 A4 Free Download Nude Photo

Isolated margin and cross margin are two different margin types available on many cryptocurrency trading platforms. Each mode has its own utility and risks. Let's understand what they are and how they work. In isolated margin mode, the amount of margin is limited to a specific position. This means that you decide how much of your funds you.

Translational activity and machinery in rice seed tissues. (AC)... Download Scientific Diagram

A main difference is the type of margins used by exchanges - isolated and cross margins are the common ones. Let's get into what these two mean. Before we discuss the different types of margins, let's briefly review what margin is. Let's say David has $2000 of his own funds as collateral for a leveraged position, this is what we refer.

There are two common ways to use margin in a trading account. Cross margin involves margin that is shared between open positions. Isolated margin, on the other hand, is margin assigned to a single position that is restricted from being shared. Cross margin helps prevent quick liquidations and has a better capability to withstand portfolio.

ONE PIECE Run ครั้งแรกในเมืองไทย

Under Isolated mode: Unrealized P&L% = Unrealized P&L / (initial margin + fee to close + additional margin added to position) x 100%. Under Cross margin mode: Unrealized P&L% = Unrealized P&L / (initial margin + fee to close) X 100%. An increase in leverage will reduce the initial margin required or vice versa.

Article 6 E0 B8 81 E0 B8 B2 E0 B8 A3 E0 B9 80 Free Download Nude Photo Gallery

Cross margin traders can further limit their potential losses by setting a stop loss at appropriate levels. Cross Margin Example. Another example shows why cross margin is the best choice for traders.