How to create TFN 🇦🇺australia YouTube

You should get your TFN within 20 days after this interview. The ATO will mail your Tax File Number to the postal address you filled in your application. However, if you are an Australian resident or an Australian passport holder, you have a special option to apply for a TFN online. Using myGovID, you will receive your Tax File Number (TFN.

LE TAX FILE NUMBER (TFN) LE SÉSAME POUR UN JOB EN AUSTRALIE

This video shows the quick and easy way to get your tax file number (TFN) in Australia. You will need your TFN or ABN before you start working in Australia.I.

How to get a TFN (Tax file Number) in Australia YouTube

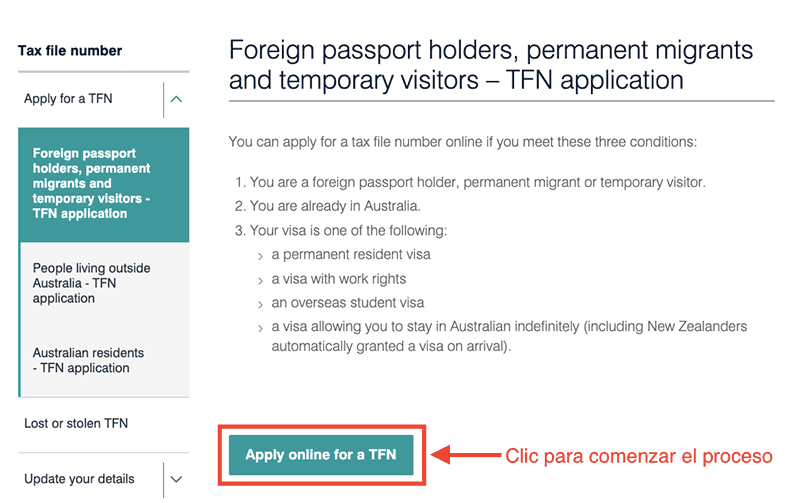

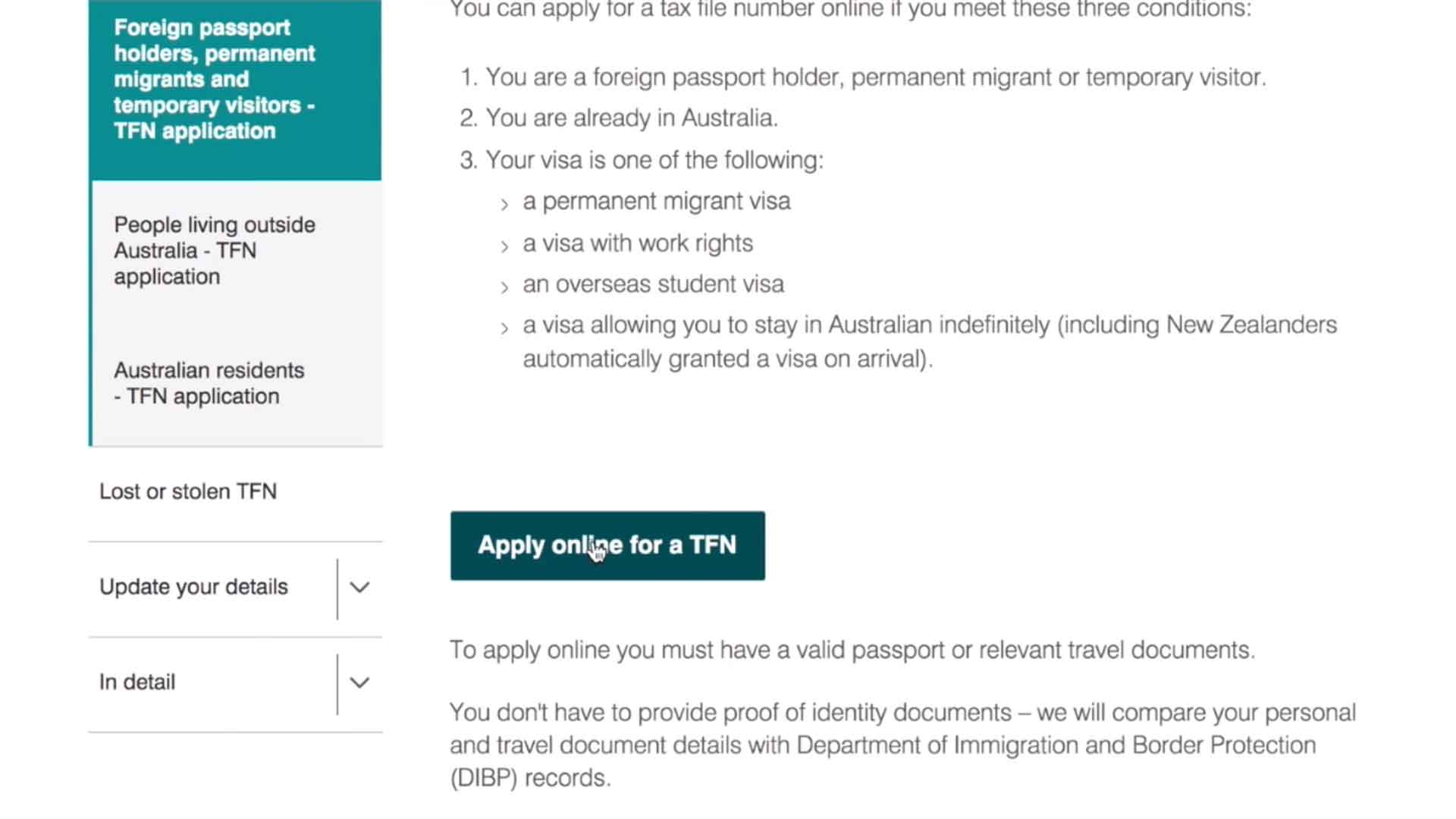

Steps to complete your online application. How you will be notified of your TFN. Use the online Individual Auto-registration (IAR) system to apply for a TFN if you are a: foreign passport holder. permanent migrant. temporary visitor. There is no cost to apply, and it should take about 20 minutes. You must already be in Australia to apply.

How to acquire your Australian TFN

Apply for a TFN. Depending on your circumstances, provide the following information in your application to help it be processed faster: Australian Company Number (ACN) or Australian Registered Body Number (ARBN) business physical locations. authorised contacts. associate's details - including name, date of birth and TFN.

Qué es el TFN ¡Sácalo YA MISMO con nuestra guía paso a paso!

Find your TFN. You only have to apply for a TFN once. If you've ever applied for a TFN, you already have one. If you've linked your ATO online services to myGov, sign in now to find your TFN. Select Australian Taxation Office. Your TFN is shown with your personal details. If you don't have a myGov account, find out how to create one and.

How to apply for TFN (Tax file Number) Simple Tax Calculators

These instructions will help individual Australian residents complete the Tax file number - application or enquiry for individuals (NAT 1432) paper form. are an Australian resident for tax purposes. Applying for a tax file number (TFN) is free. Australian residents can apply at Australia Post by completing the online form.

Everything you need to know about the Australian Tax File Number (TFN)

Cara untuk apply TFN tidak susah dan dapat proses aplikasi bisa melalui beberapa cara. Kalian bisa apply melalui Australia Post Office, Service Australia Centre atau melalui post. Pada umumnya kalian bisa mendapat TFN dalam waktu 1-2 minggu tetapi bisa juga lebih lama, bisa sampai 28 hari. brightannica.co.id.

Guide To Tax File Number (TFN) In Australia Chalo Australia

How to apply. If you are a foreign resident for tax purposes, to apply for a TFN you will need to complete a paper form. Download and complete: Tax file number - application or enquiry for individuals living outside Australia. If you can't download the form, order it either online or by phoning 1300 720 092. Send your completed TFN.

Tax File Number (TFN) Declaration Form Explained 💰 AUSTRALIA YouTube

A Tax File Number (TFN) is a unique identifier issued by the Australian Taxation Office (ATO) to each taxpaying entity — an individual, company, superannuation fund, partnership, or trust. Both domestic and international students are able to apply for a TFN via the ATO website. It is not compulsory for international students have a TFN, however we encourage international students to get one.

How To Obtain a Tax File Number (TFN) In Australia Electricity Bill Calculator

Applying Directly At ATO -. You have three options to get the TFN application form -. 1. Order it online (NAT 1432) from here. 2. Call on 1300 720 092 (This number is available 24*7) 3. Visit your nearest CentreLink office. Fill this form and send it with certified copies of identity documents to ATO.

Le Tax File Number (TFN) travail et impôts en Australie

It is free to apply for a TFN. To work in Australia, you will need authorisation (a valid visa) from the Department of Home Affairs. You can apply for a TFN if you meet all the following 3 conditions: You are a foreign passport holder, permanent migrant or temporary visitor. You are already in Australia. Your visa is one of the following

¿Qué es el TFN en Australia?📝 Edutip 3 YouTube

In this video, we will walk you through the step-by-step process of applying for a Tax File Number (TFN) in Australia. We will cover everything from who need.

How to Apply For a TFN in Australia International Student Easy Way Step By Step Sbs Vlogs

Nah, jadi setelah kalian sampai di Australia, ada banyak hal yang perlu kalian lakukan dan salah duanya adalah langsung daftar TFN dan bikin rekening bank Australia. Setelah daftar kira-kira 3 atau 4 hari lewat website ATO, kalian bisa langsung nelpon ATO di nomor 13 28 65.

How to apply TFN in Australia Necessary to do in Australia YouTube

How Australian residents for tax purposes of all ages apply for a TFN, if you don't have an Australian passport. Foreign passport holders, permanent migrants and temporary visitors - TFN application How visitors living in Australia with a valid foreign passport or travel document (visa) apply for a TFN.

How to Apply for an Australian Tax File Number (TFN) YouTube

You can apply for an individual Tax File Number (TFN) from the Australian Tax Office (ATO). It's not compulsory to hold a TFN, but it will help you to: lodge a tax return. start or change jobs. limit the amount of tax you pay on interest or dividends from savings accounts or investments. If you're operating a business as a sole trader or.

Tax File Number Australia (Guidelines) Expat US Tax

Australian residents can apply for a TFN at any age. The fastest way to apply is online using myGovID, however you will need to be 15 years old or older and have a passport to apply online using myGovID. If you don't have a passport or are under 15 years old, use one of the other application options. You're an Australian resident if you're.